Amazon Hits US Sellers With 5% Fuel and Inflation Surcharge: Reports

In an effort to offset rising costs, Amazon is shifting some of it onto sellers by adding a 5% fuel and inflation surcharge to existing fees charged to sellers in the United States, according to multiple reports.

Amazon reportedly sent a notice to sellers announcing the surcharge would go into effect April 28. It will apply to all product types.

Inflation has soared in the United States in recent months, and Amazon is trying to offset losses caused by it. It's the first time the online retailer has implemented such a fee.

"In 2022, we expected a return to normalcy as COVID-19 restrictions around the world eased, but fuel and inflation have presented further challenges," the notice stated, according to an NPR report. "It is still unclear if these inflationary costs will go up or down, or for how long they will persist, so rather than a permanent fee change, we will be employing a fuel and inflation surcharge for the first time—a mechanism broadly used across supply chain providers."

These fees charged to sellers made up 22% of Amazon's revenue in 2021, or about $103 billion, according to the Associated Press.

Amazon sellers likely will be faced with not many options to deal with the surcharge aside from raising prices themselves, or finding some way to cut costs.

The surcharge would only partially offset inflation, as prices reportedly are up about 8.5% across the board compared to last year. Large companies outside of Amazon have taken their own inflation-fighting measures, including higher airline ticket prices and fuel surcharges for ride-sharing companies.

Amazon sellers likewise will need to make major adjustments to their business to deal with this surcharge. But sellers know that raising prices carries plenty of risk. Some customers may not accept higher prices on certain products.

In online forums, sellers openly worry about inflation. One user on the Amazon Seller subreddit in March predicted that inflation would deter more shoppers from non-essential purchases, and the loosening of COVID restrictions has brought brick-and-mortar stores back into more direct competition with online sellers.

"We've found online sales have dropped about 50% in the past 1 month (where I am restrictions were basically all removed in last few weeks)," the user stated. "This is true for both our Amazon sales and our own website sales."

Added another user: "I posted a question here asking other sellers if they experience the same declining sales. Most do. One guy posted an interesting link about [how] Amazon has recruited hundreds of thousands of new sellers last year. Wow! The number of new sellers is way more than the number [of] new buyers."

On a Facebook group for Amazon sellers, users were similarly concerned.

"Very bad sales. I fear the increasing inflation costs on basically everything will cause buyers to hold their money and not buy as much," said one user.

"Sales are way down right now," said another, adding that it’s “going to get even worse” with the upcoming surcharge.

READ MORE:

Turn Amazon Data into a strategic Asset

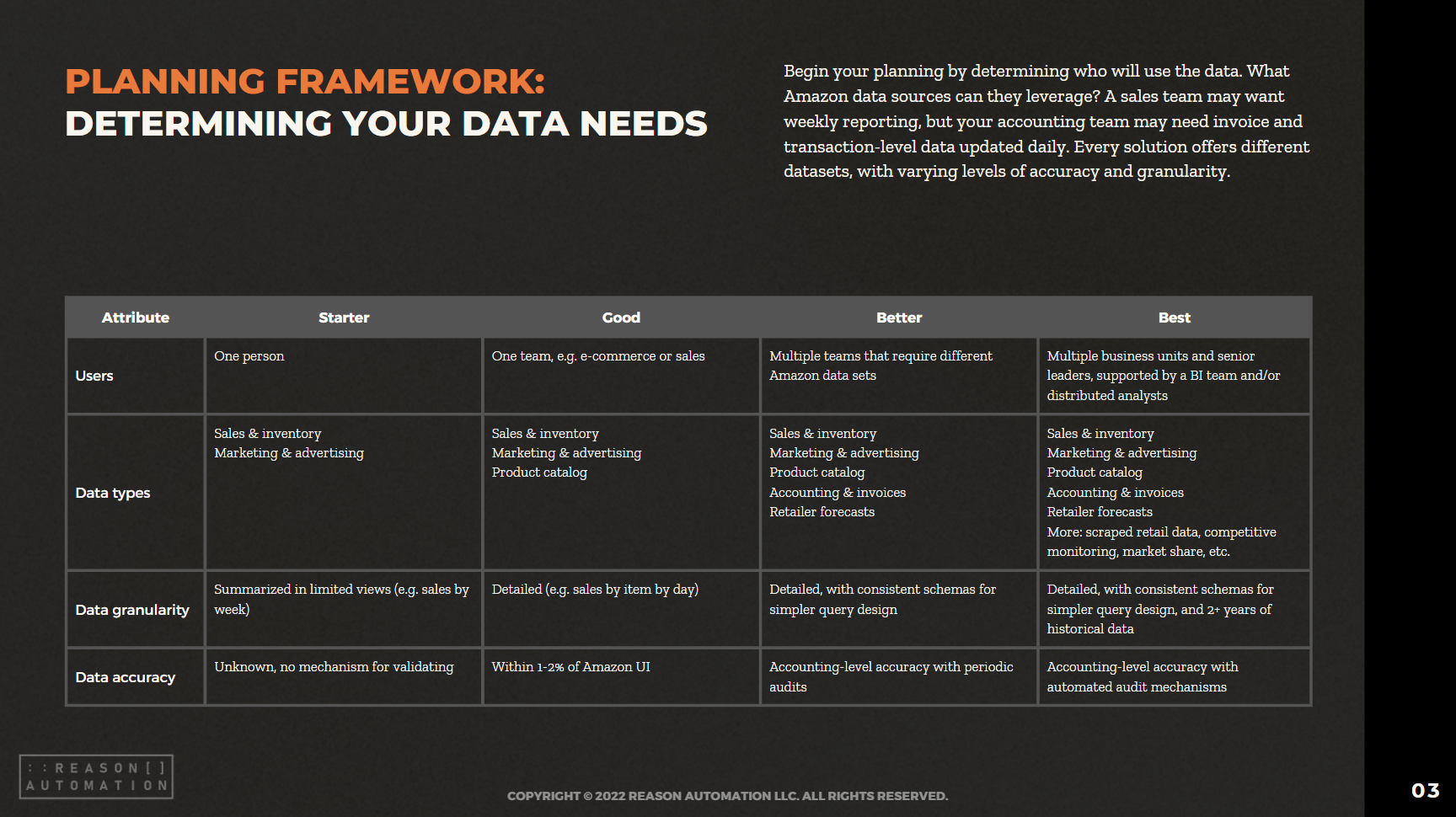

The breadth of Amazon sales, marketing, and supply chain data lets brands find patterns and insights to optimize their Amazon business and other e-commerce channels. But only if you have a plan for extracting the data from Amazon systems, storing it, and preparing it for analysis.

This guide will help you take ownership of your Amazon data—by preparing your business for a data-driven future, and analyzing the most common methods for extraction, automation, storage, and management.