Amazon and Sellers Compete Over Data: The Latest

Data is vital to the success of any business, and control of that data is key. Many of America’s largest companies have gotten to that level because they zealously control as much data as possible, and Amazon is no exception. However, their data controls often come at the expense of sellers.

Amazon sellers have long been concerned that the online retail giant has been collecting data from their Marketplace and using that to help their own private label businesses compete with those very same sellers. Now, the courts are getting involved.

This guide provides a comprehensive breakdown of the issue and a series of updates on how this competition over data is developing over time.

July 11, 2022: UK Watchdog Investigating Alleged Anti-Competitive Practices by Amazon: Reports

A UK government department that acts as a competition watchdog reportedly is launching a formal investigation into alleged anti-competitive practices by Amazon.

The Competition and Markets Authority will investigate concerns that Amazon gives an unfair advantage to merchants that pay for extra services, which allegedly hurts both consumers and their competition, according to an Associated Press report.

The AP quoted Amazon as saying they would cooperate with the investigation and that they "remain proud of the continued support we provide to businesses of all sizes across the UK."

The investigation will look at merchants who use optional extra services like storage, packaging, and delivery, and whether Amazon is using third-party data to unfairly give them a boost.

Specifically, the investigation will look at how the Buy Box is awarded, what criteria is used for placing merchants under the "Prime" label, and how data influences those decisions.

Opponents of Amazon's practices argue that the company is unfairly using third-party data to choose winners and losers among merchants, which enables them to push competitors out of the market and gain a monopoly over products and services that allows them to increase prices while reducing choice. This hurts both merchants, who are driven out of the marketplace or lose margin or market share, and consumers, who must pay higher prices.

Amazon argues that it does not engage in anti-competitive practices, and in fact provides a free marketplace that allows a level playing field for merchants to compete with each other for consumers' dollars. They say that this both provides a place for merchants to sell their products when they would otherwise have difficulty reaching an audience, and it helps keep prices low for consumers.

June 2, 2022: Sellers Clash With Amazon Executive Over Antitrust Bill in Forum

A new piece of proposed legislation has revealed a rift between some Amazon sellers and Amazon leadership.

Dharmesh Mehta, vice president of worldwide selling partner services at Amazon, recently posted in Amazon's Seller Central Forum urging sellers to oppose S. 2992, the American Innovation and Choice Online Act. However, many sellers responded saying they intended to support the legislation. A Senate committee passed the act in January and it could advance toward becoming law this summer, according to a CNBC report.

“As we have noted in previous communications to you throughout the past year, Congress is considering legislation, including S.2992, the American Innovation and Choice Online Act, that could jeopardize Amazon’s ability to operate a marketplace service and, as a result, your business’s ability to sell in our store,” Mehta stated in the post. “Recent public comments from Senate leadership indicate that they intend to vote on S.2992 later this month. I want to ensure that you are aware of this legislation and what you can do to try and stop it from harming you.”

The bill is aimed at stopping Amazon and other tech companies from favoring their own businesses and products on their own platforms, which has been a common complaint from sellers who fear they can't compete. In addition to Amazon, the bill would also affect Meta (formerly Facebook), Apple, and Alphabet (parent company of Google).

Mehta urged sellers to use a form on a website to contact their senator with a prewritten email.

Proponents of the bill say that it may protect sellers from alleged manipulation of the Buy Box, as well as the threat of Amazon undercutting seller products by slashing prices of its own products.

"I have read through this bill. Not seeing how it jeopardize[s] my ability to sell," wrote one user on the forum in response to Amazon's request. "Everything I read in the bill is pro seller."

"Amazon has gained an ever bigger share of the market while they use political sway to throw barriers to entry in the way of any would-be competition (not unlike what they do to sellers who compete with them on their own site)," added another.

Opponents, however, argue that the bill hurts Amazon, and those negative impacts will likely trickle down to sellers and to customers as well.

"I can’t predict the future, and big secret neither can the gang in Washington," said one user. "I can tell you that this bill is bad news for Amazon, bad news for Amazon customers, and if you think that doesn’t mean bad news for Sellers, then you must not be a third-party Seller."

April 6, 2022: SEC Investigating Amazon Marketplace Data Practices: Report

The U.S. Securities and Exchange Commission has been investigating how it uses Marketplace seller data for its own private label products, according to a report.

Amazon sellers have long been concerned that the online retail giant has been collecting data from their Marketplace and using that to help its own private label business compete with those very same sellers. A Wall Street Journal report indicates that the SEC is now looking into emails and other communications from senior executives at Amazon.

A WSJ investigation from 2020 determined that Amazon used third-party seller data in this fashion, although the company denies it. Specifically, WSJ's report claims they found evidence Amazon takes data about independent sellers on the Marketplace and then uses that data to create competing products.

The report is an indication that sellers need to be mindful of their data and read their agreements with Amazon to ensure they understand what data they are sharing and how Amazon may use it.

March 21, 2022: DC Court Throws Out Suit Alleging Amazon Improperly Punishes Sellers Over Pricing

A D.C. Superior Court judge has dismissed an antitrust lawsuit against Amazon that alleged the retailer improperly punished third-party sellers who charged lower prices for products on their own websites compared to the same listings on Amazon.

The D.C. attorney general claimed that Amazon had too much control over sellers, which harmed customers by driving prices higher. But the judge granted Amazon's motion to dismiss, according to multiple media reports.

A Law360 report indicated that the suit was dismissed because the court did not believe the suit had provided any evidence that Amazon's actions resulted in higher prices.

"We believe that the Superior Court got this wrong," the attorney general's office said in a statement, according to multiple media outlets. "Its oral ruling did not seem to consider the detailed allegations in the complaint, the full scope of the anticompetitive agreements, the extensive briefing and a recent decision of a federal court to allow a nearly identical lawsuit to move forward."

Back in 2019, Amazon stopped telling third-party sellers that it couldn't offer lower prices on rival sites. However, Amazon's Fair Pricing Policy states that sellers cannot "[set] a price on a product or service that is significantly higher than recent prices offered on or off Amazon."

Amazon reportedly said they are just doing what other retailers do, and that if successful, the suit would force Amazon to raise prices.

“The DC Attorney General has it exactly backwards — sellers set their own prices for the products they offer in our store," an Amazon spokesperson said, according to Engadget.

The consequences for sellers for listing products at a different price on another site include losing the "buy box" button on listings or even their selling privileges altogether.

READ MORE:

Turn Amazon Data into a strategic Asset

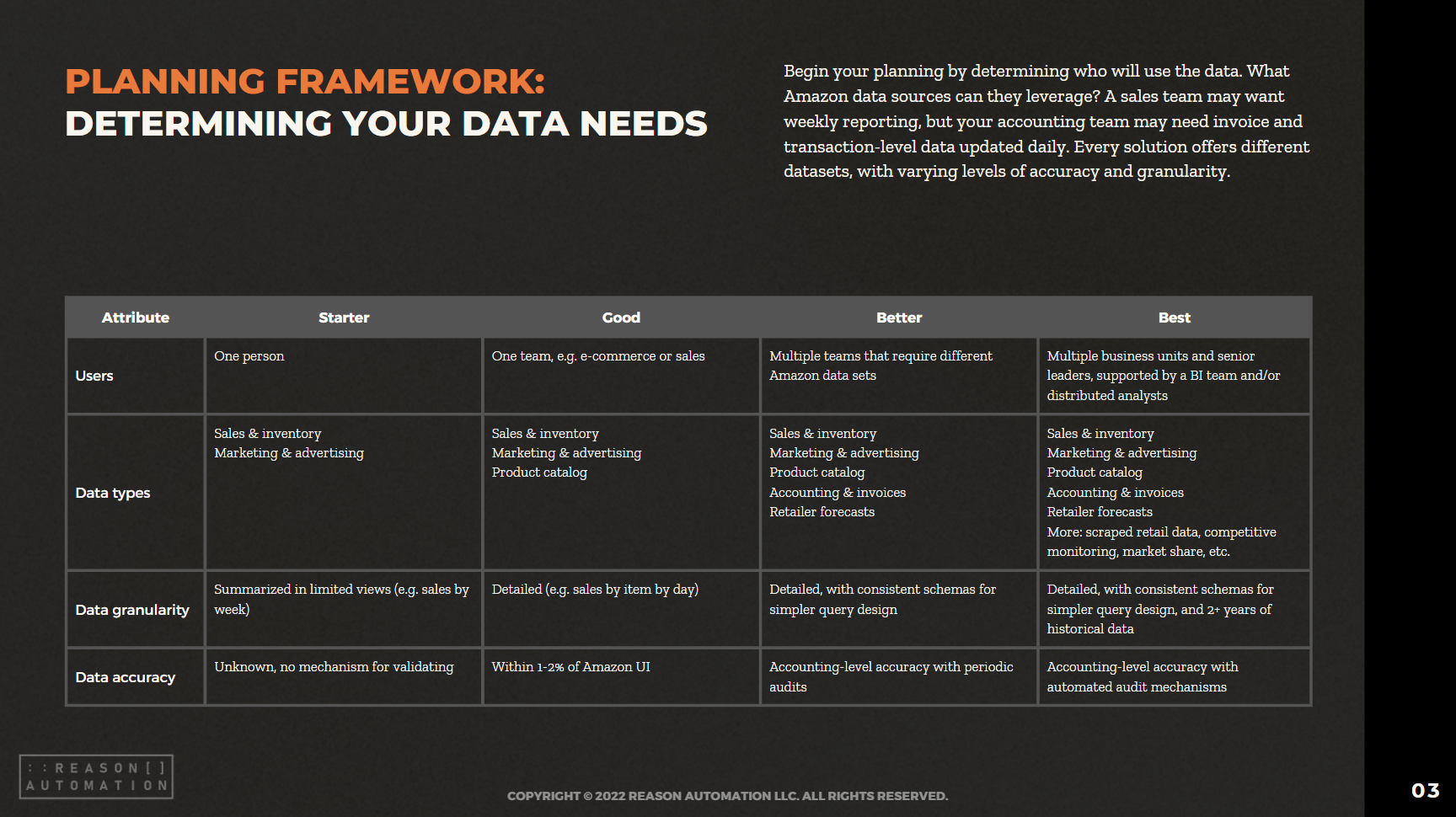

The breadth of Amazon sales, marketing, and supply chain data lets brands find patterns and insights to optimize their Amazon business and other e-commerce channels. But only if you have a plan for extracting the data from Amazon systems, storing it, and preparing it for analysis.

This guide will help you take ownership of your Amazon data—by preparing your business for a data-driven future, and analyzing the most common methods for extraction, automation, storage, and management.