Google Seeking to Build Ecommerce Competitor to Amazon: Report

Google is trying to find a way to create a rival to Amazon's marketplace for merchants with some new features in development, including one that lets visitors use photos to search for products, according to a report.

Bloomberg reported that Google executive Prabhakar Raghavan demonstrated new features at Google's I/O software conference in May that will seek to take a bite out of Amazon's market share. In addition to the photo feature, the company also unveiled a feature that would let people go from merchant listings on a Google search to their checkout pages with one click. This would, in turn, prompt more sellers to buy Google ads.

This could potentially provide a path for Amazon sellers to sell outside of the Amazon marketplace, which could be attractive to sellers who want to be less reliant on the online retail behemoth and pay lower fees in the process.

However, Google has tried to take on Amazon before with limited success, and these features are still early in development, the report notes. Additionally, Google will need to protect its own brand by keeping this new shopping experience from interfering with the current search experience that Google users rely on.

As we noted recently, a new report found that Amazon ads cost 68% less than Google. As a result, sellers should be aware that simply swapping Amazon ads for Google ads may cost more money. However, they may prove more effective and therefore worth the cost. Sellers will need to conduct their own ROI analysis to see if this is a good switch to make (if Google does go this route in the near future).

Google offering these kinds of ads could offer a way out for Amazon sellers looking for other channels to sell their products as their margins shrink at Amazon. However, sellers will need to be careful, as this represents a new business model and, for those using the fulfillment by Amazon (FBA) program, it would involve leaving behind Amazon’s formidable logistics network.

If Google does offer a more comprehensive shopping experience, it would likely be a better fit for Amazon sellers that already have a multi-channel sales operation, ship their own products, and are already looking for a way to divest from Amazon. For sellers or vendors more dependent on Amazon’s logistics and marketing network, it might be better to simply experiment with a small portion of sales through Google first.

Our Help Center has information on which reports in Amazon Seller Central contain data on Amazon ad spending and traffic, and you can use this information to crunch the numbers and understand a) exactly how much you’re spending on each ad in Amazon and b) how much traffic to your product pages they are bringing in. In particular, you will want to pay attention to the following reports:

Advertising reports: These are all of the available advertising reports for both sellers and vendors.

Sales and Traffic by SKU: This report summarizes traffic (along with sales and revenue) for all products in the seller's catalog.

Sales and Traffic by Child ASIN: This is the same as the above report, but for child ASIN.

Amazon Seller Central’s reporting provides you with information that can help you understand your ad spend and traffic data. The information in the reports allow you to be better equipped to run an experiment with Google and compare the results to Amazon. In general, it’s good to track this information anyway so you can monitor the effectiveness of your ad campaigns depending on the product.

READ MORE:

Turn Amazon Data into a strategic Asset

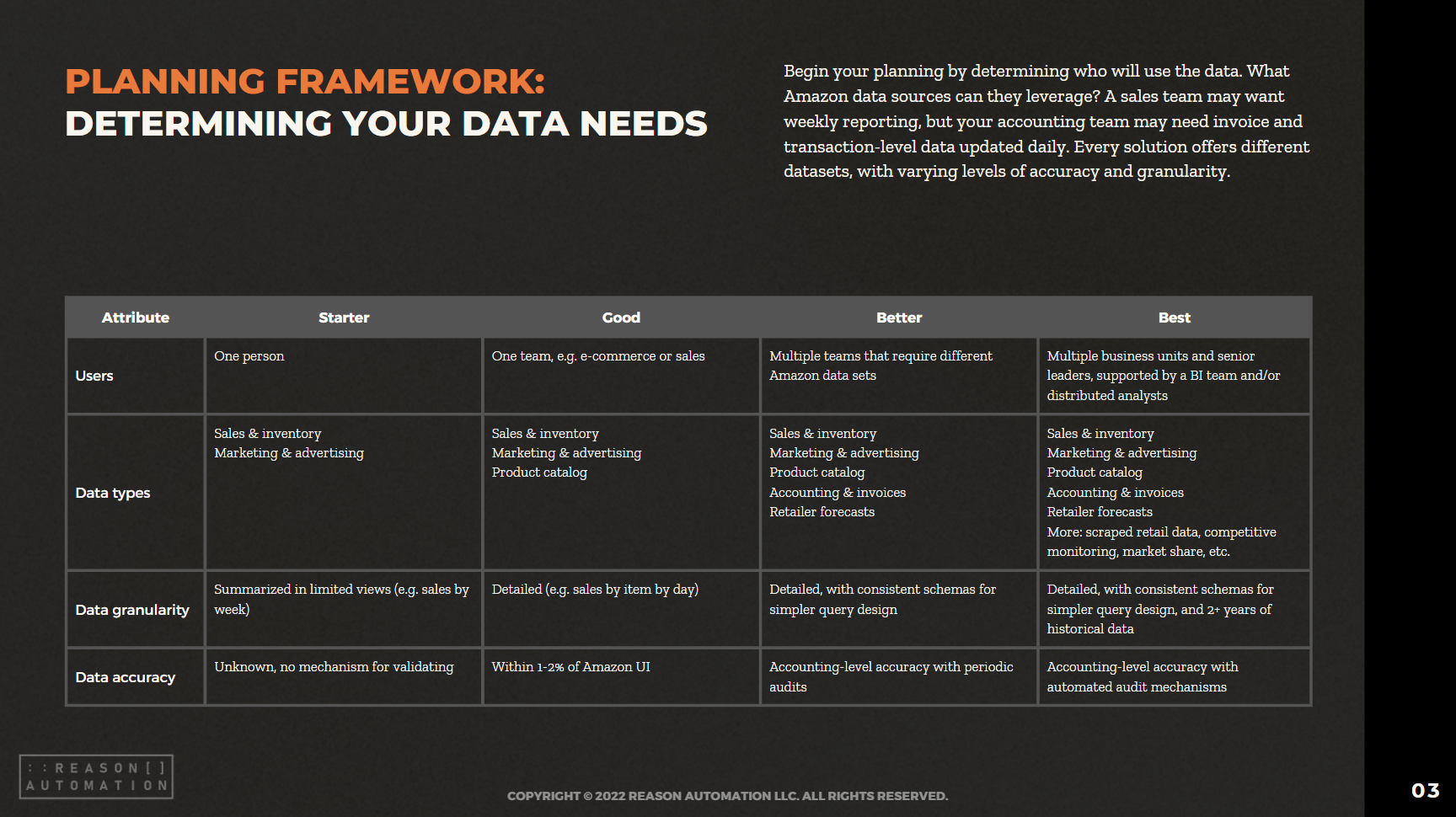

The breadth of Amazon sales, marketing, and supply chain data lets brands find patterns and insights to optimize their Amazon business and other e-commerce channels. But only if you have a plan for extracting the data from Amazon systems, storing it, and preparing it for analysis.

This guide will help you take ownership of your Amazon data—by preparing your business for a data-driven future, and analyzing the most common methods for extraction, automation, storage, and management.