Why Amazon Data Download Is So Hard for Businesses, and What To Do About It

Running an e-commerce business through Amazon is tough. You’re constantly juggling customer needs, managing a busy warehouse, and trying to appease Amazon all at the same time. But you understand those challenges and accept them as part of the game.

Accessing seller data through Amazon, on the other hand, is a frustration that many sellers don't expect to run into when they get started. E-commerce company owners end up beating their heads against the wall when it comes time to create reports to understand more about their business and what can be done better.

This is often frustrating for sellers. Why is accessing Amazon seller data this aggravating? And can anything be done about it?

Fortunately, there are answers. As ex-Amazonians and e-commerce operators ourselves, we know the ins and outs about how the company works, so we've decided to put together this broad overview of Amazon data.

What Is Difficult About the Amazon Data Download Process?

So what issues do sellers typically run into when trying to access data? Let's consider the example of a Brand X, which is selling through Seller Central.

Brand X knows it needs data and which data is most valuable. Brand X goes into Seller Central and expects to get specific analyses that are standard for managing e-commerce or retail businesses, like:

How did a certain item do over a specific time period?

How many widgets were sold last week?

How much inventory should you have compared to the amount of demand you're seeing?

How many weeks until you run out of inventory?

How much inventory is on its way?

How much is charged by shipment, by month, and by product?

All of those questions can be answered by downloading Amazon reports. But instead of grabbing one or two reports from the dashboard with a couple clicks, you need to download several hundred reports.

Why? Because Amazon makes you download the data for a single day for every single product. If you want to combine all of these days and products into one report, guess who has to do it? That's right: you. Unless you hire someone to do it for you.

Essentially, to get access to the data, a seller has to do the following:

Filter a report for a specific date

Download the report

Choose another day

Download that report

Repeat this over and over again for each day they want to compare

Stitch those reports together manually to get a full history

How Do Sellers Access Amazon Data?

So how do sellers deal with this issue? The truth is, there are many different methods that sellers currently use to access Amazon seller data — more ways than would be useful to describe here. But generally, there are five main methods:

1. Use the Amazon Seller Central Dashboard

The first option is to not bother with parsing and dissecting Amazon data at all. In this scenario, a seller simply uses Amazon Seller Central’s dashboards within their own user interface, and settles with the default reports provided by Amazon.

Amazon has a number of basic reports it provides to sellers within Seller Central. For example, an All Orders Report provides order and item information, and allows sellers to see details on order status and fulfillment.

This method is best for:

Small businesses who only deal with a handful of different products.

Sellers with low sales volume.

2. Download Reports Manually

As a result, sellers have to download multiple reports — sometimes dozens — and then have to manually piece together the data to get the answers they need.

Sometimes, sellers will hire people outside the company to manually download the reports. They often hire an Amazon Virtual Assistant, who works remotely and takes on different tasks for an Amazon business. Unfortunately, this method has four main downsides:

It requires extensive training

It is often ineffective

It doesn't offer the seller personal insight and suggestions based on what has worked or hasn't worked in the past

It creates a potential security issue

This method is best for:

Companies who only need to do basic reporting

Small businesses that don’t generate a lot of data to begin with

Owner-operated businesses that don’t have the time to do extensive data analysis

3. Use a Pre-Built Solution

One of the solutions many sellers resort to is to use a pre-built third-party platform that can provide meaningful data to them.

The companies that develop these platforms aim to build a better reporting system for the client by doing the data extraction themselves and putting it in a dashboard. It's a full-service solution. but the downside is that you will need to use somebody else's dashboard.

The problem with this is that every seller has their own individual needs and inevitably become frustrated at these one-size-fits-all solutions. For example, if you're a company that manages 10 different products, the type of dashboard you need is completely different than if you manage 10,000 products. At the 10-product level, you can manage each product individually. But when you manage 10,000 products, you have to manage them by category. Most dashboards are built to show ASIN-level detail or aggregated detail, but not both.

As a result, they use these services for a little while, and maybe even enjoy them at first, but eventually their highly specific needs push them to just export the data to a spreadsheet and do the reporting themselves.

This method is best for:

Relatively small e-commerce companies

Companies who deal with a small range of products and a basic logistical structure

Firms that just want a simple dashboard with basic insights they don’t have time to produce themselves

4. Connectors and APIs

Connectors and APIs are another potential solution.

Connectors like Power My Analytics provide a hub for managing client data sources and integrating key data reports, creating reports and visual dashboards you can use. Connectors automate data collection and make it easier for your team to collaborate on data. You can then integrate data sources with third-party platforms like Google Data Studio or Google Analytics.

Amazon's Selling Partner API is a modernized API-based automation functionality that serves as an evolution from the legacy Amazon Marketplace Web Service APIs. Amazon MWS offered sellers access to numerous Amazon features, and SP-API aims to go a step beyond its capabilities while also offering the service to vendors as well as sellers.

This method is best for:

Sellers who need access to good data but want to manage the data in-house.

Companies that want to automate as much of the process as possible to save time.

Businesses that need to integrate with third-party platforms.

5. Get a Custom Solution

The fourth option, and what larger sellers typically find to be the best solution, is to hire a service to get the data out of Amazon systems like the third-party platforms mentioned in the previous section.

The difference with this custom solution compared to the full-service approach is that the data is collected and then put into another visualization tool of the user's choice, such as Tableau or Microsoft's Power BI.

Instead of being forced into a one-size-fits-all dashboard with reports that can't be customized, the user is able to get the data and choose the visualization service that works best for them, whatever that may be. This is the solution that we at Reason Automation ultimately decided to provide based on feedback from our clients and our own experience working within Amazon.

This method is best for:

Experienced e-commerce companies

Moderate- to large-sized companies looking for something more sophisticated yet customizable

Companies that depend on data to make big decisions about their company

E-commerce firms that have unique needs different from those of most other companies

Companies that want to do a better job spotting inefficiency and opportunities for growth

Why Does Amazon Make Its Data So Difficult to Access?

All of this begs the question: why on Earth does the largest online retailer on the planet, a company that could easily fix this issue, make data such a pain?

For sellers who have dealt with Amazon for a long time, the short answer is abundantly clear: Amazon doesn't spend much money or attention on anything that doesn't earn them a lot of revenue. They're very good at focusing only on big-picture ideas that allow them to gobble up market share, which is why they've been able to grow so large and dominant.

Unfortunately, that means issues that are "little" for them — like fixing their reporting system — that are big issues for sellers get left by the wayside. It's just not worth Amazon's time, in their mind.

There's also the issue of how Amazon is structured. In most companies, you'd have a hierarchy of interconnected teams. In Microsoft, there's a team for Word, a team for Excel, and smaller teams within them for handling individual features of those products. But at Amazon, each individual feature has its own team, and they may not be interconnected. So if you log in to Seller Central and you see five elements on the page, rest assured that five different teams built those. This creates problems for interoperability and a cohesive customer experience.

It's not that Amazon is bad at what it does. Quite the contrary: they're good at recognizing what makes them money. No one's done the work to show them how better reporting will help them gain significant revenue, so they don't do it.

Why Is Data So Important to E-Commerce Businesses?

"That's great," you think. "But I'm just here to sell widgets. I don't care about all these complicated metrics. Why can't I just get by on these downloadable reports?"

If you're a really small e-commerce business, you might be able to get away with this. But the problem is that these reports are like a two-dimensional, low-resolution image of your business, when what you need is a 3-D, high-resolution model to help you understand every facet of your company and how it's operating.

By collecting all relevant data, you can create robust analyses because you’ll be able to join the data sets together more accurately. You can combine an aggregated sales report that says how many units you sold with another report that shows how many units that you shipped out each month that will help you spot inefficiencies and opportunities to increase your profits. You can't do that with these one-day snapshots from Amazon.

Think of it this way: if you were a military trying to identify enemy troops in a specific location, the default method would be to say, "I need to count troops by downloading reports from the satellite." Instead of that, you could have a company like us walk up to you and say, "here's your complete troop manifest."

If you're interested to learn more about us and what we do, schedule a free demo today so we can walk you through the process and see if we can identify a data solution that fits your company.

READ MORE:

Turn Amazon Data into a strategic Asset

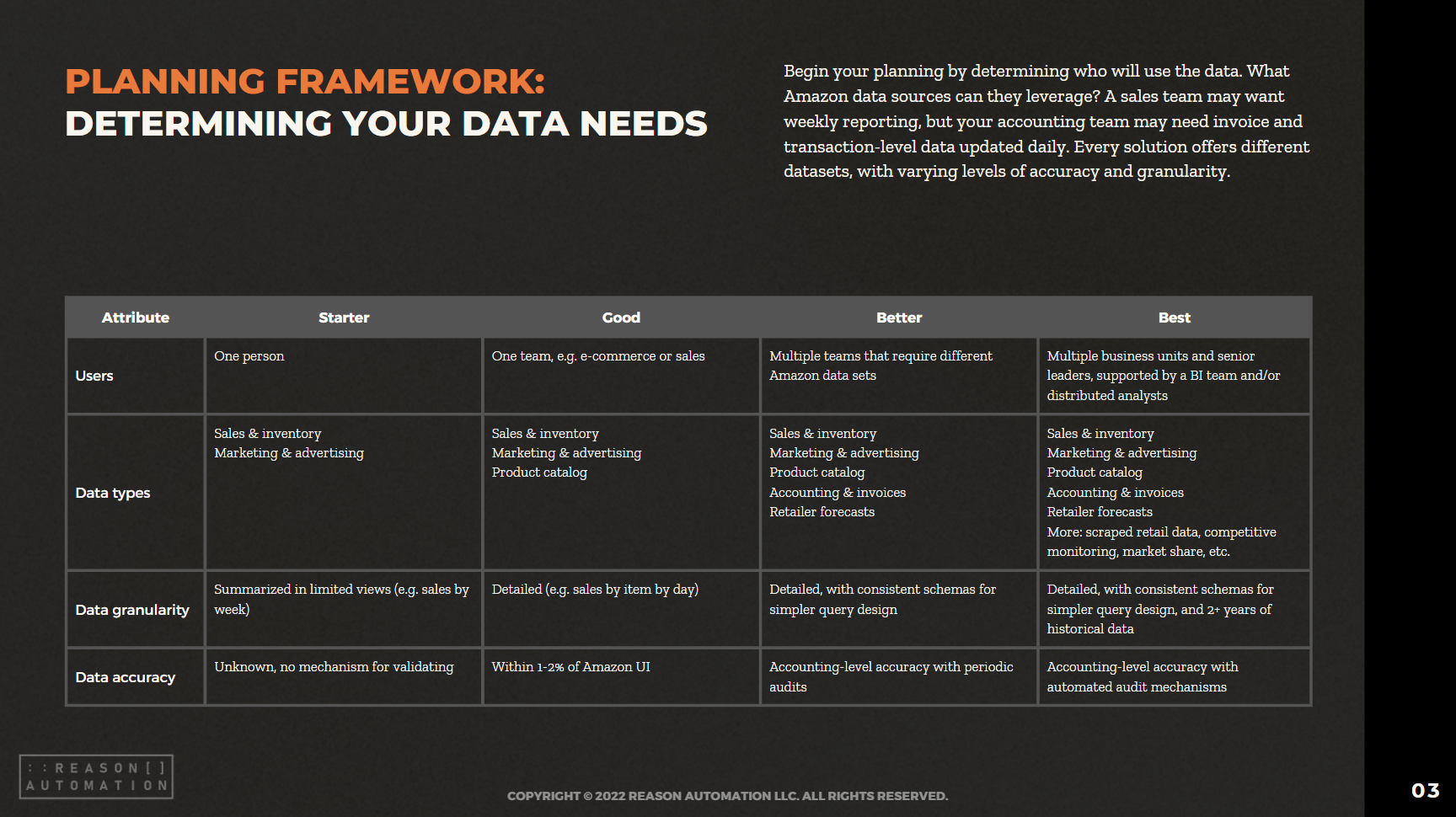

The breadth of Amazon sales, marketing, and supply chain data lets brands find patterns and insights to optimize their Amazon business and other e-commerce channels. But only if you have a plan for extracting the data from Amazon systems, storing it, and preparing it for analysis.

This guide will help you take ownership of your Amazon data—by preparing your business for a data-driven future, and analyzing the most common methods for extraction, automation, storage, and management.