Amazon Launching Cash Advance for Sellers in 2023

Amazon is launching a new cash advance option for sellers starting in early 2023, the company announced in a statement. However, some sellers warn that this is an expensive funding option for ecommerce companies.

Amazon will partner with seller growth capital company Parafin to offer a "secure financing option [that] ties payment on the cash advance to a portion of sellers’ future sales for a fixed capital fee and provides eligible Amazon sellers with easy and quick access to capital when they need it, paired with flexible payment plans," the statement reads.

"With this program, sellers can access capital in a matter of days with transparent and capped rates, no fixed term, no personal guarantee, no credit checks or excessive paperwork, and no late fees," it continues.

Read more Amazon Seller Central news:

Amazon Sellers Will Soon Be Able to Email Market Directly to Customers

Amazon Promotes Tool for Sellers to Refund Unhappy Customers

Amazon says the program is already available to some U.S.-based businesses, and it will be available to "hundreds of thousands of eligible sellers" by early 2023.

Sellers will be able to access capital ranging anywhere from $500 to $10 million in order to expand their business, protect margins, develop new products, grow inventory, and/or efficiently manage cash flow, the company says.

Amazon determines the payment schedule based on a fixed percentage of the seller's Gross Merchandise Sales (GMS) until the total amount borrowed is paid off. There are no minimum payments or interest, nor is there a need for the seller to put up collateral, unlike with most loans.

"Payments are only required during periods that a seller has made sales, and the fixed payment rate ultimately protects them during periods of slow or no sales," the statement reads. "This financing option will provide sellers that have been selling on Amazon.com for at least three months with an additional solution for their financial needs alongside the existing financing solutions portfolio of term loans, interest only loans, and lines of credit provided by Amazon and its third-party financing partners."

While Amazon emphasizes that the lending option doesn't have interest, several sellers on the Amazon Seller Forum argue that this cash advance program is essentially a high-interest loan -- at its highest the quicker you pay it off, and lowest if you keep it in place for a year. That's because the loan involves an up-front fee baked into the total amount of the loan.

According to an example provided on Parafin's website, a merchant approved for up to $30,000 would receive $26,000, with a capital fee of $2,444 for a total amount owed of $28,444. Parafin would then take a 12% cut of daily sales until the amount is paid in full.

A seller who only needed the funding for a month would essentially pay $2,444 for a month's worth of funding, while a seller who needs the funding for a full year would be paying about $200 per month for funding.

Regardless of the cost to the seller, this cash advance system does provide a potentially helpful new funding option -- however, sellers who just need a short-term funding option may want to explore other lending options to see if they can get a better deal. Even sellers who will stretch out the funding for a year may be able to find better terms elsewhere and should shop around first.

Read more Amazon Seller Central news:

READ MORE:

Turn Amazon Data into a strategic Asset

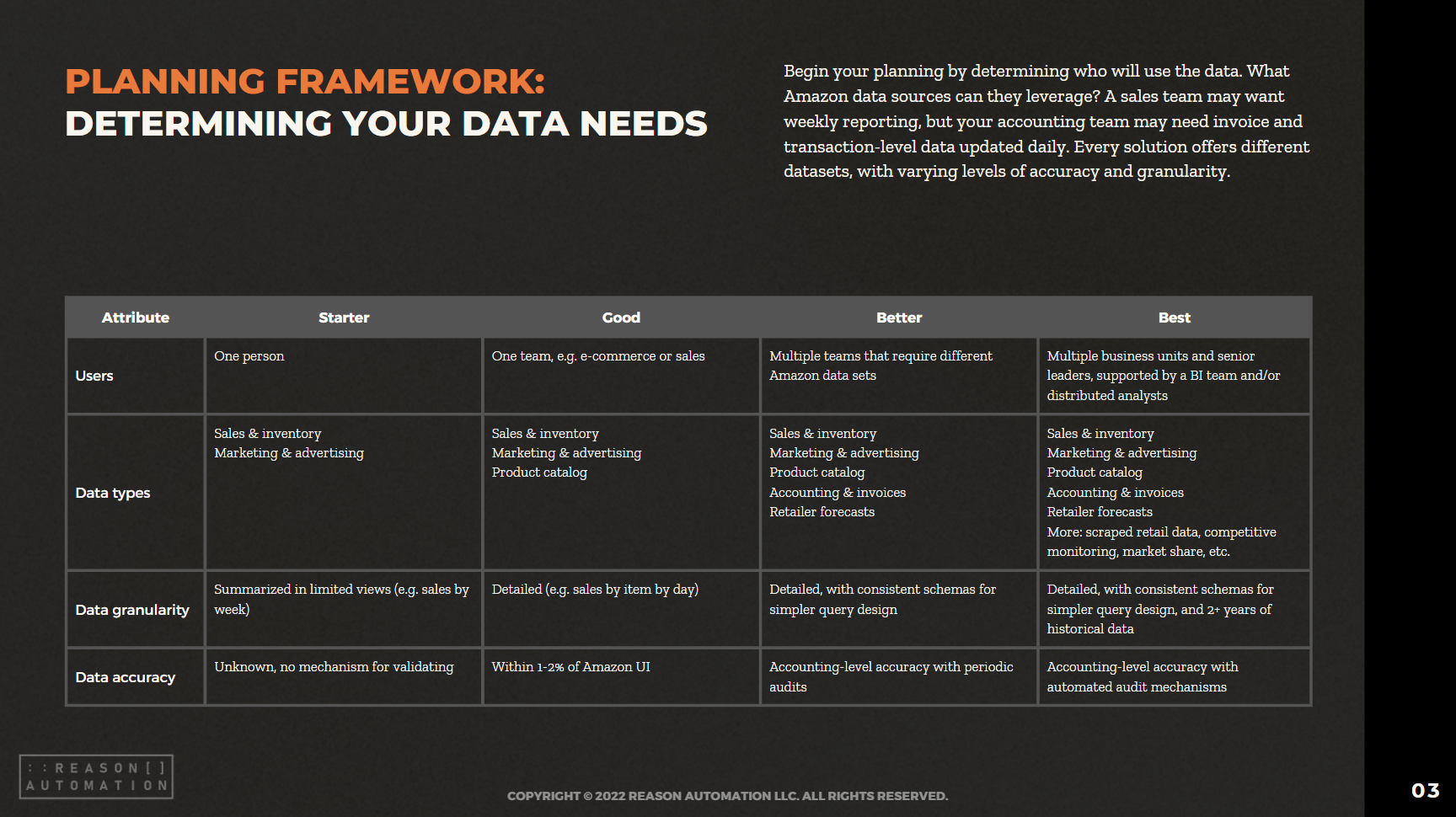

The breadth of Amazon sales, marketing, and supply chain data lets brands find patterns and insights to optimize their Amazon business and other e-commerce channels. But only if you have a plan for extracting the data from Amazon systems, storing it, and preparing it for analysis.

This guide will help you take ownership of your Amazon data—by preparing your business for a data-driven future, and analyzing the most common methods for extraction, automation, storage, and management.