Amazon Mobile App Sessions and Pageviews now available in Seller Central

On March 29, 2022, Amazon added mobile app traffic to Seller sales and traffic reports for the first time. This is a major update to Amazon seller central reporting with significant implications for how brands measure detail page conversion, ad performance, and more.

Many sellers were surprised that Amazon has withheld such important data, given mobile’s growing role in e-commerce and shopping. Amazon product detail pages look completely different on mobile, and the new data may cause sellers and agencies to reprioritize the mobile shopping experience.

We dove into the details of what Amazon changed, and its implications for Amazon seller analytics.

New mobile traffic data available

Mobile app sessions and page views will be available as new columns in seller sales and traffic reports. In other words, this is new/incremental data: Amazon has not previously reported on mobile app traffic, has now made ~12 months of history available. There are now three columns for sessions, with corresponding versions for page views:

Browser sessions: This is the same session data Amazon has always reported on, now labeled “browser” sessions. According to Amazon, this category has always included both mobile and desktop browser traffic.

Mobile app sessions: This is new/incremental session data attributed to the Amazon iOS and Android apps.

Total sessions: This is all sessions, regardless of channel or user agent.

Impact to conversion

Seller Central reports conversion rates as “unit session percentage.” Did your conversion rates suddenly plummet? Until March 29, this metric was calculated using “browser” sessions only. Now it is calculated using total sessions, inclusive of the mobile app. Some caveats:

Because Amazon is only backfilling 12 months of mobile app traffic, keep in mind that current “unit session percentage” data includes mobile, but data older than a year excludes mobile. We therefore recommend against year-over-year comparisons using unit session percentage.

If you calculate conversion manually with a formula or query, we recommend updating that formula to use the “total” version of your traffic metric.

It’s not possible to calculate mobile-only conversion yet, because Amazon doesn’t attribute sales or revenue to mobile.

Traffic data is still ambiguous

While the additional data is welcome, it’s still impossible to separate mobile traffic from desktop traffic because mobile data is present in both traffic subtypes. In addition, Amazon only provides mobile attribution for traffic and sessions, but not for orders, units, revenue, or advertising campaigns. This makes it impossible to leverage mobile traffic to calculate mobile-specific metrics like conversion rate and customer acquisition cost. Until this data becomes available sellers will continue gleaning whatever insights they can from aggregate numbers, while reprioritizing mobile CX in general.

"The new carve out of mobile app traffic is a step in the right direction for Amazon," said Tyler Wallis, managing partner of ecommerce consultancy The Lab. "Many brands are now seeing that 70-80% of their Amazon traffic is coming through mobile where Amazon renders images more prominently than on desktop browsers. The old adage of 'a picture is worth a thousand words' is now sinking in for brands on Amazon, and brand investments in listing content should be aligned appropriately."

READ MORE:

Turn Amazon Data into a strategic Asset

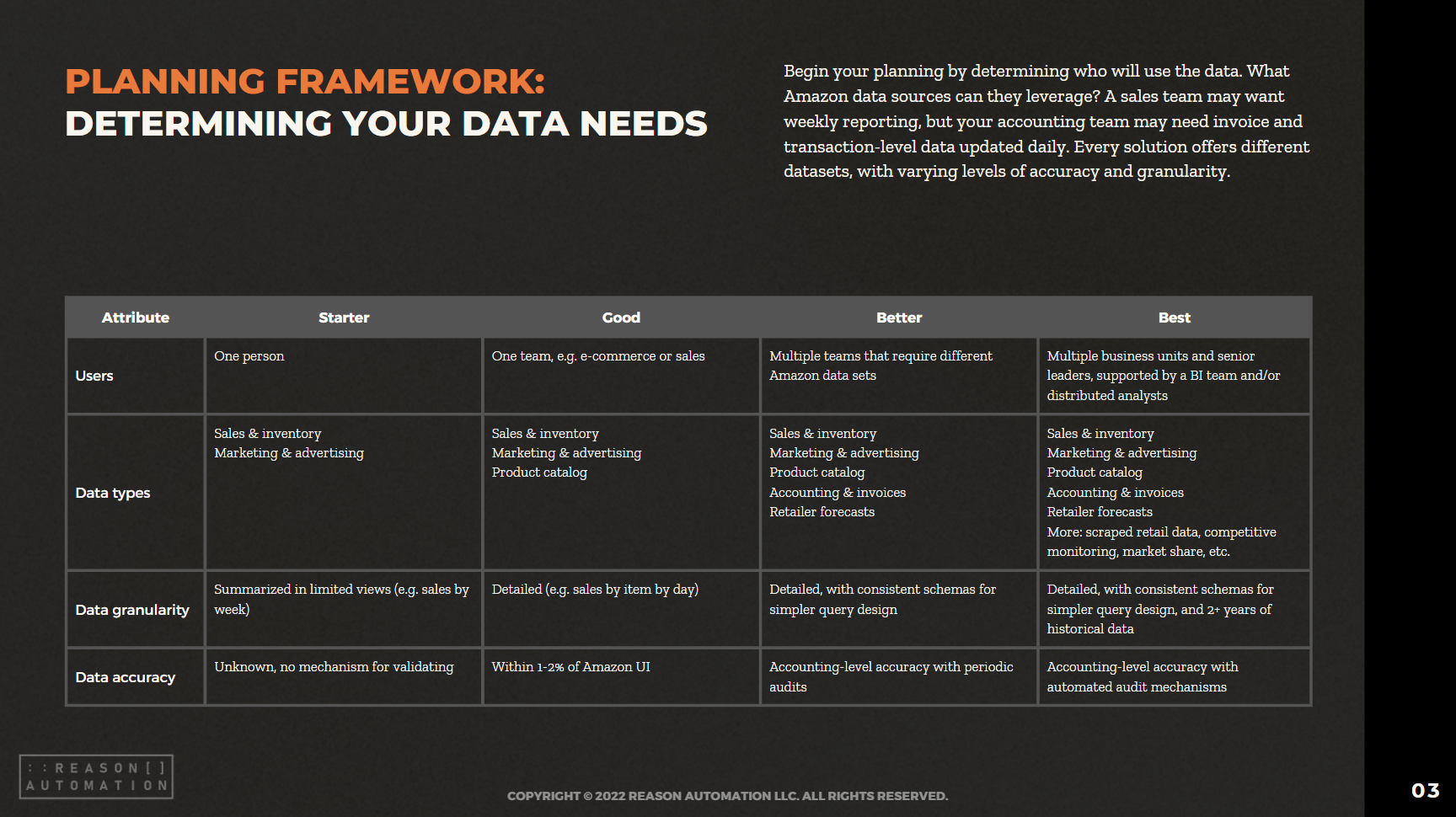

The breadth of Amazon sales, marketing, and supply chain data lets brands find patterns and insights to optimize their Amazon business and other e-commerce channels. But only if you have a plan for extracting the data from Amazon systems, storing it, and preparing it for analysis.

This guide will help you take ownership of your Amazon data—by preparing your business for a data-driven future, and analyzing the most common methods for extraction, automation, storage, and management.