Amazon Vendor Analytics: How to Understand Your Data

As a vendor, you are constantly operating on thin margins. You’ve got to watch costs while boosting profitability whenever possible, and there are many different things that affect both profits and costs. The key to making the right decisions is to analyze the data you’re collecting, but that can be difficult to do.

This guide provides some pointers on how to do Amazon Vendor Central analytics, and how to use your data to make some business decisions that will actually boost your bottom line.

How to Get Started With Amazon Vendor Central Analytics

The best way to start off is to measure your business performance in terms of Amazon data, and then compare it to your internal data, which will give you the other half of the picture.

To do this, you will need to access reports in Vendor Central depending on what kind of information you’re looking for. Here is a description of each report and how to understand them:

Sales: Use three reports in particular – Ordered Revenue, Shipped Revenue, and Shipped COGS – to fully understand your company's sales through Amazon. Shipped COGS is probably the best report of the three to understand your sales.

Traffic: The Traffic Diagnostic report tracks the number of visitors to your product detail pages on the Amazon website.

Inventory: The Inventory Health report is a daily snapshot of products that are stored in Amazon fulfillment centers, sorted by sellable status and age.

Amazon provided forecasts: Amazon publishes their forecasts in the Forecast: Ordered Units and the Forecast: Shipped Units reports.

Net profitability: Download the Net PPM (Product Profit Margin) report to see figures on the net margin that Amazon expects to make on a product based on vendor-provided funding.

These reports will provide broad data that will allow you to do high-level analytics of what is happening in your company. You should be able to spot some trends just from reading through this data. We recommend downloading the report from Vendor Central and using data visualization software such as Power BI, Google Data Studio, or Tableau to make it easier to spot trends within the data.

Note: Downloading these reports manually and aggregating them on your own is time-consuming, so download our whitepaper (see below) on how to do it more effectively.

Examine Operational and Coop Reports

Once you have gone through these higher level reports, you can start getting into the more granular ones for deeper insights. Operational reports that are helpful here include the following:

Defect tables: There are two reports to examine here: Defect Report / Chargebacks and Defect Report / Chargebacks: Direct Fulfillment. Both of these reports provide information on chargebacks Amazon has made to the vendor.

Confirmed POs: Confirmed Purchase Orders shows the POs Amazon places to a vendor and their respective statuses.

Shipments: The Shipments report tracks what happens when a product is shipped, including the number of cartons, the carrier, and so on.

Your coop data is also vital. Coop agreements are unique to vendors: they govern the close relationship between Amazon and vendors when it comes to things like marketing, logistics, and more.

There are many coop data categories. You have volume incentives where you get a percentage discount when you hit certain volume targets; accruals like an Amazon damage allowance where you must pay for damage to products; and vendor-funded sales discounts.

These are the kinds of reports you would go over with your accounting or finance department. By going through these reports, you can see how much you're paying for these types of activities, and where you might have opportunities for savings.

Some key coop reports include:

Start Doing Advanced Vendor Analytics

Once you’ve done the basic-level analysis of your sales, coop agreements, and more, you can start getting into more advanced analytics. When you start conducting this level of analysis, you’re able to make adjustments in your business that can help you firm run more efficiently, and therefore save money while boosting profits.

Example 1: Sales Forecasting

For example, you can start working on your sales forecasting. Use your internal sales data to create forecasts, and then compare it to Amazon’s forecasts of what they think they’re going to sell.

Then, compare that to how many purchase orders Amazon currently has. Does it match up with Amazon’s forecasts? Does it match up with your own internal forecasts? Where are the discrepancies, and why are there discrepancies? Then, make adjustments to your internal forecasts if you feel they are out of sync with reality upon reviewing this data.

Example 2: Customer Insights

Through advanced analytics, you can also understand your customer better, and therefore make better marketing and product decisions. Examine data on things such as repeat purchases and demographics to understand what the typical customer looks like, why they’re buying your products, and any surprising details that could help you understand them better – such as people in one particular geographic region buying your product at a certain time of month.

Important business insights are buried in your data. If you know how to read that data, you have an advantage over your competitions.

Where Should a Company Start With Vendor Analytics?

All of this information can seem overwhelming, and it may be hard to figure out where to start. The key is to just jump in and start examining the data that is most relevant to your main problem (i.e., lagging sales revenue, low traffic, high cost of coop agreements), and then asking yourself some questions about what you can do in response

For example, let’s say you want to figure out how to be more efficient with items you keep in stock, so you aren’t keeping too much in stock but have enough to meet demand. In that case, you want to pay attention to whatever Amazon is shipping, because whatever they are shipping, they’re going to turn around and order again. Keep an eye on how sales are trending, and then start asking yourself some questions.

Can we identify why sales are going up/down?

Are we actually in stock with items that are selling (if not, you’re going to lose sales)?

Are we winning the featured offer in the Buy Box?

If not, how can we make our price more competitive to win the Buy Box?

There are many different ways to approach Amazon vendor analytics, but this guide should give you ideas on an initial approach. Practice makes perfect, so make it a habit and set aside time each week to review your data for insights. If you’re having trouble manually downloading reports and aggregating the data so you can do that analysis, refer to our free whitepaper below.

READ MORE:

Turn Amazon Data into a strategic Asset

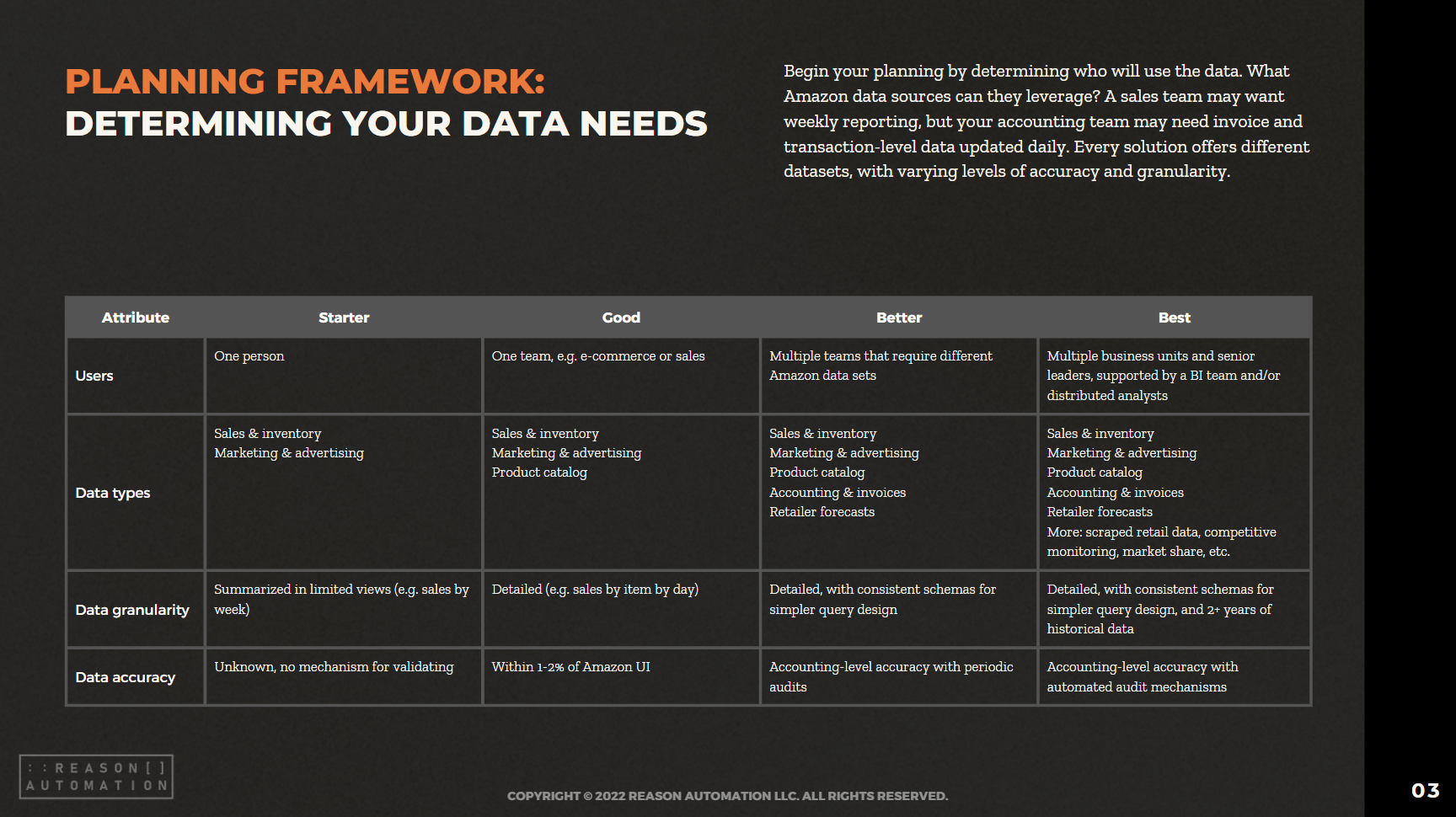

The breadth of Amazon sales, marketing, and supply chain data lets brands find patterns and insights to optimize their Amazon business and other e-commerce channels. But only if you have a plan for extracting the data from Amazon systems, storing it, and preparing it for analysis.

This guide will help you take ownership of your Amazon data—by preparing your business for a data-driven future, and analyzing the most common methods for extraction, automation, storage, and management.