Amazon Vendor Scorecard: A Guide to Understanding and Enhancing Your Performance

Every year, Amazon vendors know to expect one thing: the annual trade negotiations. This can be an intimidating process, and a lot is riding on the end result of these negotiations.

That's why it's essential to understand the Amazon vendor scorecard, and what it means for your business.

What Is the Amazon Vendor Scorecard?

An Amazon vendor scorecard is an informal term for how Amazon tracks the performance of vendors. Amazon ranks a vendor on a variety of metrics, such as how profitable they are to Amazon, how healthy their sales growth is, and how high their defect and chargeback rates are. Amazon uses this scorecard to rank vendors against their competitors.

This scorecard becomes highly important during a vendor's annual negotiations with Amazon, as Amazon will use information on the scorecard to demand concessions from a vendor if they are weak in certain categories. On the flip side, a vendor can request better terms if they perform strongly compared to their competitors.

Some of the metrics the scorecard is based on include:

Financial performance

Sales growth

Net PPM (profitability for Amazon)

Confirmed purchase order rates

Lost Buy Box

Vendor lead time

Related article: 5 Tips for Negotiating Amazon Coop Agreements

Why Is the Amazon Vendor Scorecard Important?

The purpose of the vendor scorecard is to create a benchmark that lets vendors know how they’re performing, which in turn has a big impact on your relationship with Amazon. The better your scorecard, the more attention (and therefore better service) you'll get from Amazon. A strong scorecard means more resources will be available to you, and you'll be in a strong position when the annual negotiations with Amazon come around.

Whatever you call it, the scorecard is what Amazon uses to determine the amount of attention you receive. Amazon vendor managers can't provide the same level of service to all, say, 2,000 vendors in their category, so they have to prioritize who gets the personalized attention and regular in-person meetings, and who gets the automated system. You want the former, so you need to make sure your scorecard is solid.

Amazon used to have levels of service for their vendors. There were three tiers: silver, gold, and platinum.

Silver: You might get one meeting per year with your vendor manager and some limited opportunities.

Gold: You would get a monthly or perhaps quarterly meetings with a vendor manager and more access to resources, like marketing vehicles and merchandising programs.

Platinum: There were probably a single-digit number of vendors in each category at this level. If you achieved platinum, you’d get unlimited meetings with your vendor manager and category leader, plus a lot more access to individuals who can fix problems that might come up like, say, an important shipment hasn't shown up.

This system was reportedly discontinued around 2016 or 2017. It’s unclear whether Amazon has replaced this system with something else (or plans to do so). However, you can be confident that your scorecard still has an impact on your level of service, and it most definitely helps with negotiations.

The important thing to keep in mind is that the vendor scorecard is the quantified measure of your relationship with Amazon and how they feel about you. If they feel really good about you, your business will benefit greatly. So you want that scorecard to sparkle.

Related article: Amazon Freight Allowance: How to Get the Best Terms

If My Products Are Performing Well, Is That Enough for my vendor scorecard metrics?

Unfortunately, simply posting strong sales might not be enough to satisfy Amazon. That’s because the scorecard is not just about how well you’re doing, but how well you’re doing in comparison to your competitors. So if your competitors are improving at a faster rate than you, you may actually be going backwards in Amazon’s eyes. This can be particularly frustrating for vendors.

Related article: Amazon Net PPM: Why Vendors Must Track This Metric

However, Amazon will clearly communicate to you what they expect. After all, they want you to meet those expectations, so you need to know what they are. During their annual meeting with you they'll tell you that you're stuck in silver because you had a worse vendor lead time than competitors, or you didn't meet a profitability level by a certain number of basis points. Pay close attention to what they tell you, and map out a plan to fix it.

How Can I Improve My Company’s Amazon Vendor Scorecard metrics?

The best thing you can do to ensure you are well-prepared to negotiate with Amazon over your vendor scorecard is to be prepared. And you can be prepared by monitoring certain key metrics. When you know what metrics Amazon is going to pull, and you’ve been keeping track of those metrics on a regular basis, you’ll be prepared with a strong argument for your case during negotiations.

Andrea Leigh, a consultant who often assists vendors with annual negotiations with Amazon, uses what she calls the "F.I.R.M. Framework." It consists of these four steps:

F = Find Your Data (make sure you have all the important metrics at your fingertips, such as chargebacks, shortages, and advertising fees)

I = Isolate Your Points of Leverage (understand what it is that you're bringing in terms of value to Amazon, such as growing faster than competitors or you have better profitability than other brands)

R = Relax & Go Slow (don't rush to close the negotiation; evaluate each of Amazon's asks)

M = Mine for Information (use this opportunity to ask a lot of questions about your business, such as how you're performing relative to competitors and what Amazon would like you to adjust)

The main issue you are going to run into in tracking these metrics is compiling all of them into an accessible report. While Amazon allows you to download all of these data points in Vendor Central, unfortunately you must download them manually and combine multiple time periods together manually as well.

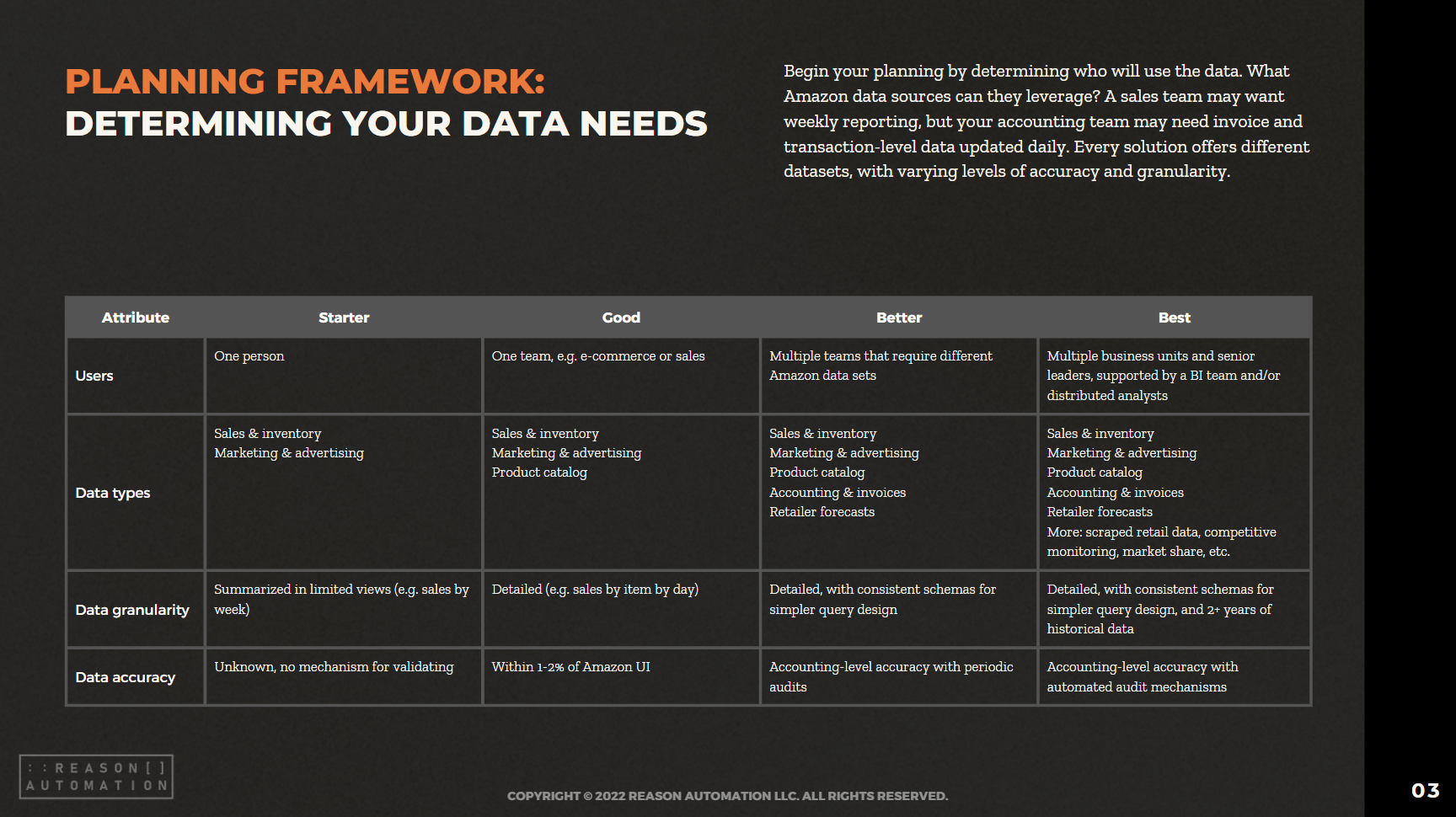

Fortunately, there are third-party services that will help you do this. We’ve created a whitepaper that breaks down these services so you can determine which one makes the most sense for you. You can download this free whitepaper below.

READ MORE:

Turn Amazon Data into a strategic Asset

The breadth of Amazon sales, marketing, and supply chain data lets brands find patterns and insights to optimize their Amazon business and other e-commerce channels. But only if you have a plan for extracting the data from Amazon systems, storing it, and preparing it for analysis.

This guide will help you take ownership of your Amazon data—by preparing your business for a data-driven future, and analyzing the most common methods for extraction, automation, storage, and management.